Doing some house history? We may have another resource for you!

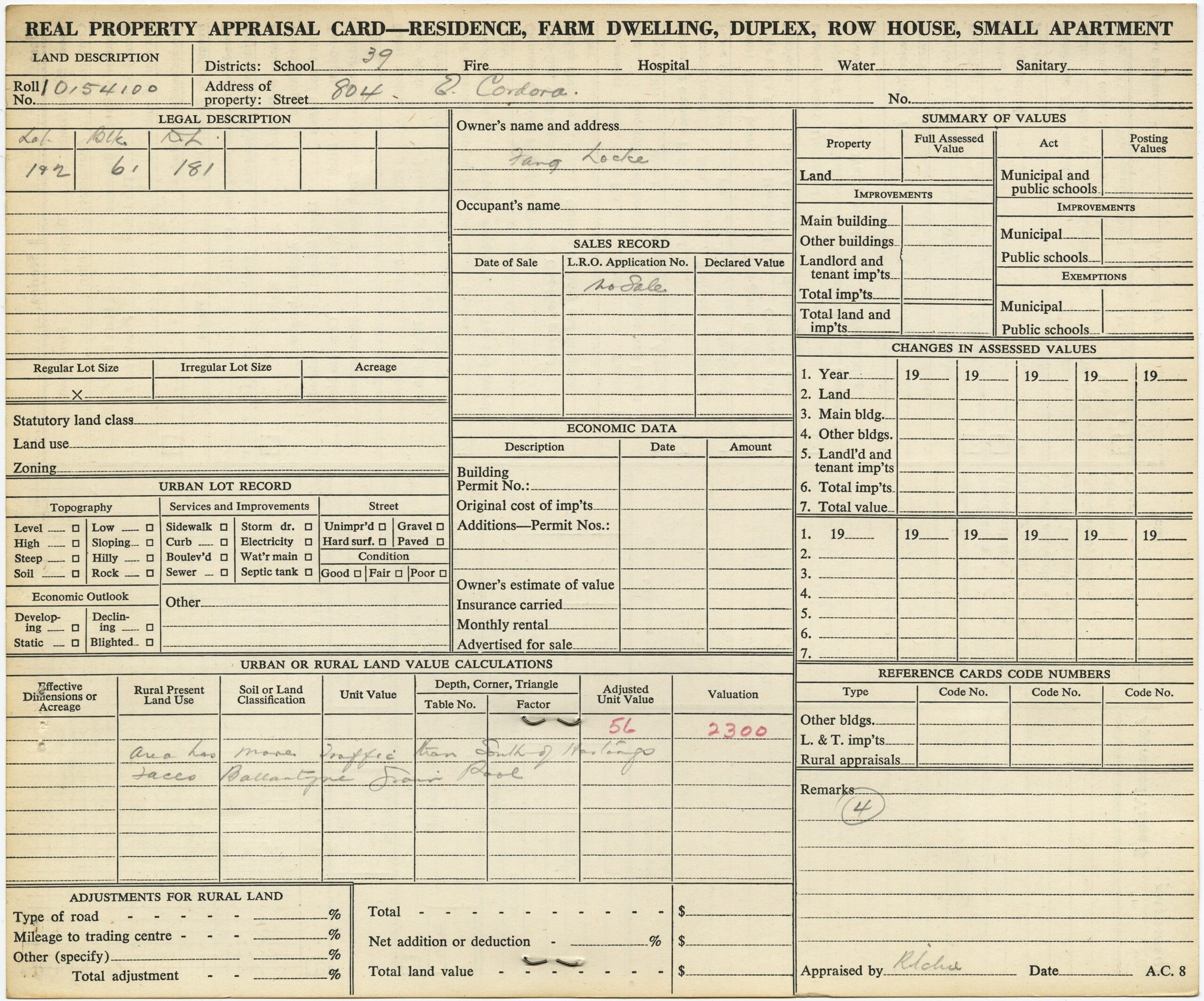

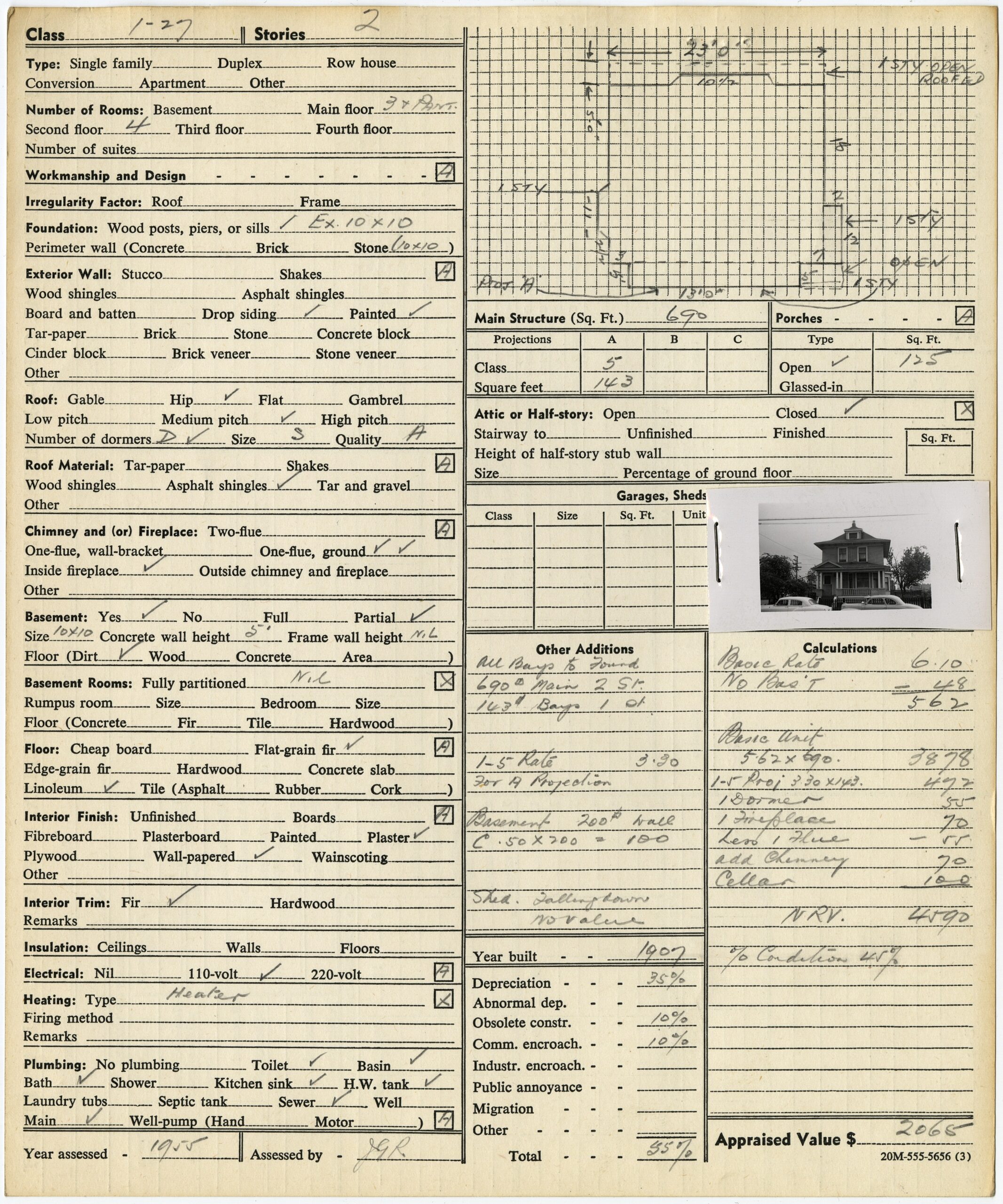

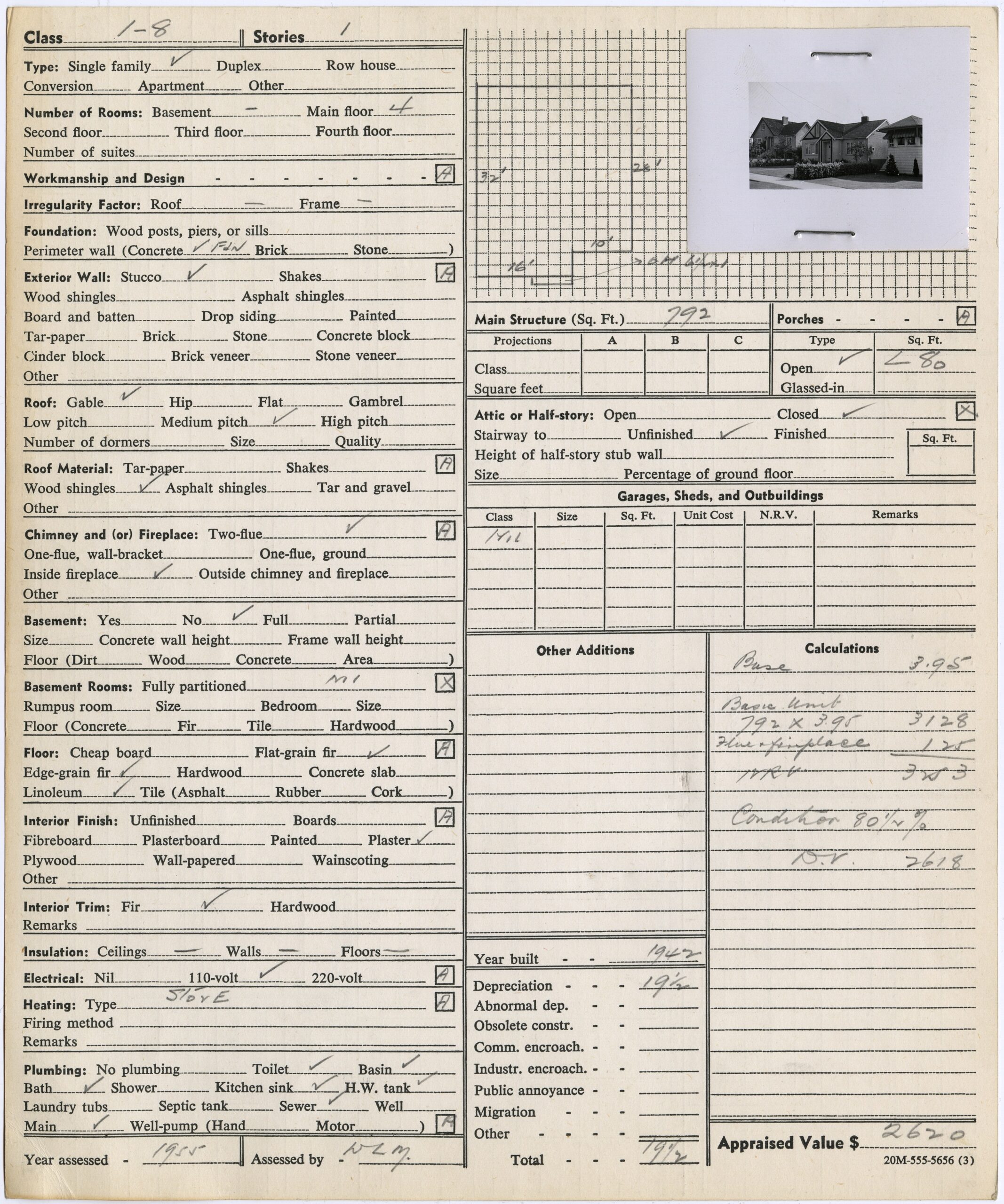

The Real property appraisal cards, Series 296 of the City of Vancouver fonds, is a group of records that contain detailed information from 1955 for 783 individual houses throughout Vancouver. These records are veritable gold mine for house history researchers with their detailed property information and inclusion of house photographs.

Although this series of records has been available to the public for years, it was difficult to find due to database descriptions that only listed the records by tax roll numbers – numbers which required cross referencing to determine what properties were associated with them. To help make these records more discoverable in our database, each card is now listed individually with its corresponding property address and legal description in addition to the tax roll number.

The information on each card includes owner, sales record, number of rooms, construction and finishing materials, heating type, year built, square footage, diagram of house footprint, assessment calculations, and in most cases, an accompanying photograph of the house. Some of the cards have further notations such as, ‘Area has more traffic than south of Hastings. Faces Ballantyne Grain Pool,’ or ‘House in fair condition and appears well kept.

However, the contents of the records aside, some may be wondering why exactly were these records created?

The production of property tax assessments was the responsibility of each municipality within British Columbia until the Province took over the task in 1977. Within the City of Vancouver the annual tax assessment was completed by the Office of the Assessment Commissioner (1886-1965), and later the Assessment Division (1966-1978).

In 1953, the Provincial government passed the Assessment Equalization Act, which named a Provincial Assessment Commissioner, who had a certain amount of power to question and disagree with the tax assessment values determined by a municipality. The Commissioner also had the power to call for a full or partial tax reassessment of properties. In 1955, the Province ordered Vancouver to increase that year’s assessment by 12.5%. The Province based its assessment calculations and percentage increase on its own sample of 248 properties. The City appealed this tax increase order to the British Columbia Assessment Appeal Board. During the hearing, the Board determined that both the Province’s and the City’s assessments contained a number of errors. They upheld the tax increase, but reduced it to 10% from 12.5%. It also concluded that before the approval of any other tax increases, a new sampling of properties needed to be conducted, and that this new sampling should be done by teams of municipal and provincial assessors working together.

Shortly after the Board handed down its verdict on June 6, 1955, Frank Hillier, the provincial senior improvements officer, and W.M. Ouimette, the provincial statistician, spent time at City Hall selecting the properties to include in the new detailed assessment sample. They chose a sample that added to around 1% of the houses in Vancouver. This equated to just under 800 properties, the results of which are these detailed real property appraisal cards.

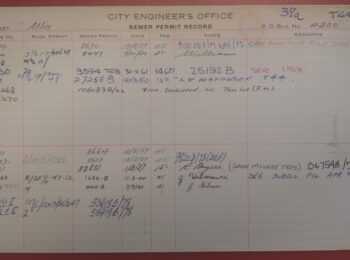

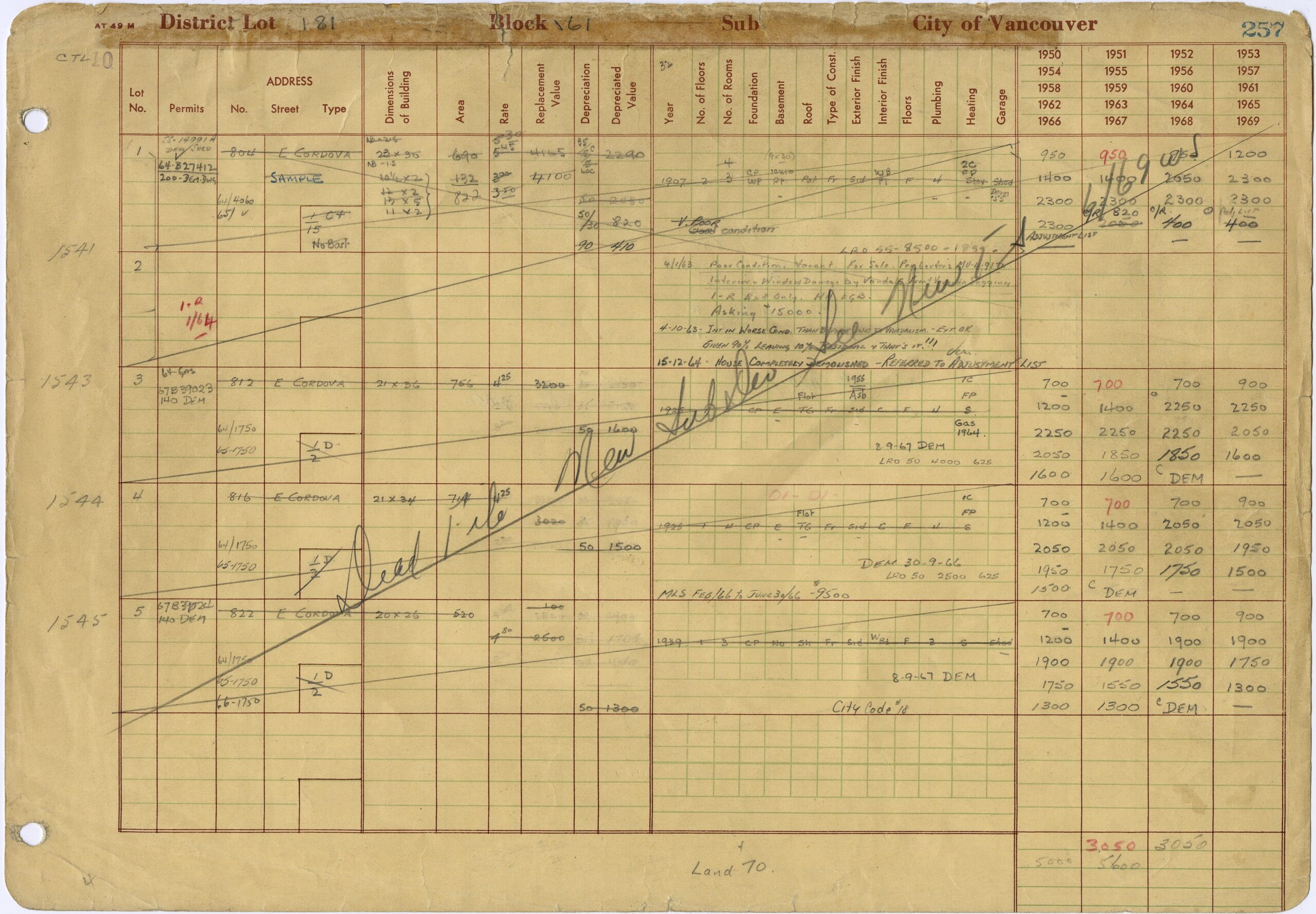

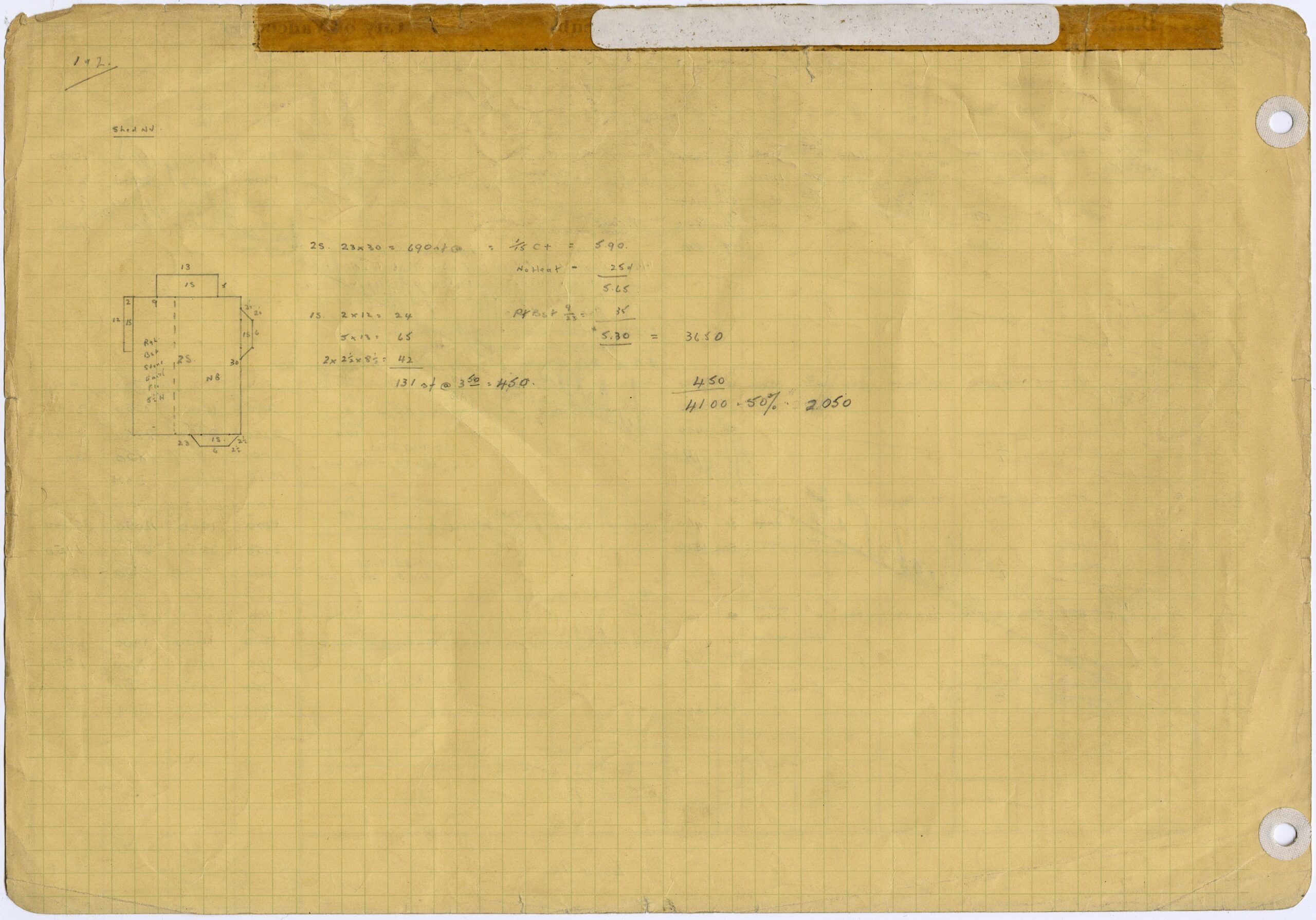

The real property appraisal cards connect with another group of tax assessment records that the Archives hold – the Property tax appraisal field notes (Series 283). Most properties included in the Real property appraisal cards Series have the annotation ‘SAMPLE’ in their corresponding field note page. The appraisal field notes were likely the records Hillier and Ouimette used to determine their sample group.

The property tax appraisal field notes, though not as detailed as the appraisal cards, and lacking accompanying photographs, do provide a wealth of information for a larger number of properties throughout Vancouver. The field notes date from 1950-1969. Some of the details included in the notes are dimensions of buildings, replacement value, depreciated value, year built, number of floors, and rooms. In some cases, the last name of the owner is noted. On the reverse side of many of the ledger sheets, there is additional information for some properties, including the outline of buildings’ footprints and additional notes. If the property you are researching is not included in the Real property appraisal cards, the Property tax appraisal field notes may be a good alternate option.

In addition to these two series, other tax assessment records that may be useful for property research include the Property tax assessment maps, and the various property tax records, as detailed in our past blog post: Vancouver property tax records to 2005 now available at the Archives. All of these records can be accessed in our Reading Room. Happy researching!